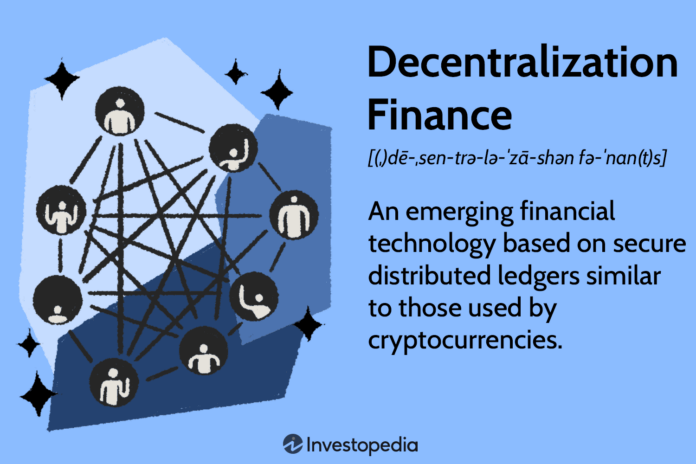

Welcome to a groundbreaking exploration of the future of finance! In recent years, an unstoppable force has emerged, disrupting the traditional banking landscape and democratizing financial services for all. Say hello to DeFi – short for Decentralized Finance.

In this article, we’ll embark on a captivating journey into the realm of DeFi and its transformative power. So buckle up as we navigate the world of blockchain, cryptocurrencies, smart contracts, and decentralized applications (DApps) that are redefining the very essence of money, banking, and wealth management.

Table of Contents

Understanding DeFi: More Than Just Buzzwords

At its core, DeFi refers to a new financial system that operates without the need for intermediaries like banks. Instead, it leverages blockchain technology, specifically smart contracts on platforms like Ethereum, to create a decentralized ecosystem of financial products and services.

Imagine a world where loans, insurance, trading, and savings are conducted peer-to-peer, with no central authority controlling your assets. That’s precisely what DeFi brings to the table – financial freedom, autonomy, and transparency.

The Building Blocks of DeFi

To grasp the potential of DeFi, let’s break down its foundational elements:

1. Blockchain: The Backbone of DeFi

At the heart of DeFi lies blockchain technology. Blockchains are decentralized, immutable ledgers that securely record transactions across a network of computers. This tamper-proof feature ensures transparency and builds trust among users.

2. Smart Contracts: Code that Empowers

Smart contracts are self-executing contracts with the terms directly written into code. Once certain conditions are met, the contract automatically enforces the agreed-upon actions without intermediaries. These smart contracts power various DeFi applications, eliminating the need for manual verification.

3. Decentralized Applications (DApps): Bridging the Gap

DeFi is fueled by decentralized applications (DApps) that run on blockchain networks. DApps offer a user-friendly interface, making it easy for anyone to access DeFi services. From lending platforms to decentralized exchanges (DEXs), DApps are the gateway to the world of DeFi.

The Promise of DeFi: Unlocking Financial Opportunities

The rise of DeFi has introduced a plethora of opportunities and benefits for individuals and businesses worldwide:

1. Financial Inclusion: Banking the Unbanked

In regions with limited access to traditional banking services, DeFi offers a lifeline. By enabling financial services through smartphones and internet connectivity, DeFi empowers the unbanked and underbanked populations to participate in the global economy.

2. Borderless Transactions: A Global Economy

Traditional banking often imposes high fees and delays in cross-border transactions. DeFi eliminates these barriers, enabling seamless and low-cost international transfers, leveling the playing field for businesses and consumers worldwide.

3. Yield Farming: Earning Passive Income

Yield farming, a popular DeFi concept, allows users to earn rewards by staking their cryptocurrency assets in liquidity pools or lending platforms. This opens up opportunities for passive income generation, offering an alternative to traditional investment strategies.

4. Ownership and Control: Be Your Own Bank

In DeFi, you have complete ownership and control over your assets. You are your own bank, with no need to trust a third party to manage your funds. This self-custody model aligns with the ethos of decentralization and privacy.

Challenges and Risks: Navigating the DeFi Landscape

As with any revolutionary technology, DeFi comes with its fair share of challenges and risks:

1. Security Vulnerabilities: The Dark Side of Decentralization

While decentralized systems provide robust security, smart contracts are not immune to vulnerabilities. Exploits and hacks on DeFi platforms have occurred, leading to significant financial losses. Ensuring code audits and security protocols is crucial to mitigate risks.

2. Regulatory Uncertainty: Taming the Wild West

The decentralized nature of DeFi raises questions about compliance with existing financial regulations. Governments and regulators are still navigating this uncharted territory, leading to uncertainties and potential legal hurdles for DeFi platforms.

3. Volatility and Market Risks: Rollercoaster Ride

The cryptocurrency market’s inherent volatility poses risks for DeFi users. Rapid price fluctuations can impact the value of assets held within DeFi protocols, potentially affecting users’ overall financial stability.

Embracing the DeFi Revolution: How to Get Started

If you’re eager to dive into the world of DeFi, here are some steps to get started:

1. Research and Educate Yourself

Knowledge is power. Take the time to learn about DeFi, its various applications, and the risks involved. Familiarize yourself with different platforms and their track records before diving in.

2. Start Small and Stay Informed

As with any investment, start with a small amount that you can afford to lose. Stay informed about the latest developments in the DeFi space, as it evolves rapidly.

3. Choose Reputable Platforms

Stick to well-established and reputable DeFi platforms with a track record of security and reliability. Avoid unknown platforms that may carry higher risks.

4. Keep Security a Priority

Protect your assets by using strong passwords, enabling two-factor authentication, and using hardware wallets for secure storage.

Embracing the DeFi Ecosystem: Navigating the Landscape

As we continue our journey through the ever-evolving DeFi ecosystem, it’s important to understand the diverse range of opportunities and applications it offers. Let’s explore some of the key aspects that define this exciting landscape:

1. Decentralized Exchanges (DEXs): Trading with Autonomy

Decentralized exchanges (DEXs) have emerged as one of the most popular applications within the DeFi space. Unlike traditional centralized exchanges, DEXs enable peer-to-peer trading of digital assets without the need for intermediaries. By connecting users directly to each other’s wallets, DEXs provide greater security and control over funds. Some prominent DEXs include Uniswap, SushiSwap, and PancakeSwap.

2. Yield Farming: Cultivating Rewards

Yield farming, also known as liquidity mining, is a captivating concept within the DeFi universe. It involves providing liquidity to various DeFi protocols in exchange for rewards, often in the form of additional tokens or fees. Yield farmers allocate their assets to liquidity pools, allowing other users to access those assets while earning rewards for their contribution.

3. Decentralized Lending and Borrowing: Empowering Financial Inclusion

DeFi lending platforms enable users to lend their digital assets and earn interest, or borrow assets against collateral. These platforms remove the need for a traditional bank as an intermediary, expanding financial access to anyone with an internet connection. With instant access to credit and competitive interest rates, DeFi lending is revolutionizing the borrowing and lending landscape.

4. Stablecoins: Bridging the Gap

In a market known for its volatility, stablecoins offer a stabilizing presence. These cryptocurrencies are typically pegged to a fiat currency or a basket of assets, ensuring a steady value. Stablecoins play a crucial role in DeFi by providing a stable medium of exchange and a safe haven for users seeking to mitigate market risks.

Risks and Considerations: Navigating the DeFi Terrain

While DeFi brings forth exciting possibilities, it’s essential to acknowledge the risks and considerations associated with this novel financial landscape:

1. Smart Contract Risks: The Code is Law

Smart contracts are the backbone of DeFi applications, but they are not infallible. Bugs or vulnerabilities in smart contracts can lead to financial losses for users. Conduct thorough research and due diligence before interacting with any DeFi platform, and be mindful of potential risks.

2. Impermanent Loss: A Unique Challenge

Users providing liquidity to DeFi platforms may face impermanent loss, a phenomenon where the value of the assets in a liquidity pool diverges from the value of the same assets held outside the pool. Understanding impermanent loss is crucial when participating in yield farming or liquidity provision.

3. Regulatory Developments: A Shifting Landscape

As DeFi continues to grow in popularity, regulatory scrutiny may increase. Changes in regulations could impact the availability and accessibility of certain DeFi services, leading to potential disruptions or uncertainties within the ecosystem.

4. User Errors and Scams: Vigilance is Key

In the decentralized world of DeFi, users are solely responsible for their actions. Be cautious of phishing scams, fake websites, and malicious actors trying to exploit vulnerabilities. Double-check URLs, use hardware wallets, and stay vigilant to protect your assets.

The Road Ahead: Unlocking the Full Potential of DeFi

As DeFi paves the way for a more inclusive and democratic financial landscape, the journey is far from over. The road ahead will be characterized by innovation, regulatory developments, and widespread adoption.

For DeFi to realize its full potential, key challenges must be addressed. Scalability and interoperability between different DeFi protocols are essential to accommodate a growing user base and enable seamless interactions between platforms. Additionally, improving user experience and accessibility will play a vital role in attracting mainstream adoption.

Conclusion: The DeFi Frontier Awaits

As we reach the end of our journey through the DeFi landscape, one thing becomes clear: the future of finance has arrived, and it’s more empowering and inclusive than ever before. DeFi’s decentralized nature challenges the traditional financial norms, offering an exciting frontier of possibilities.

As the DeFi space continues to evolve, remember to tread cautiously, equip yourself with knowledge, and embrace the potential of this revolutionary financial ecosystem. Whether you’re a seasoned investor or an enthusiastic newcomer, the DeFi revolution welcomes you to participate in shaping the future of finance.

So, are you ready to seize the opportunities that DeFi presents? Step into this realm of financial sovereignty and embark on a thrilling adventure that is changing the game forever.