In recent years, the retail landscape has undergone a significant transformation with the rise of the “Buy Now, Pay Later” (BNPL) model. This innovative approach allows consumers to make immediate purchases and spread their payments over time, often without interest. In this comprehensive article, we delve into a multitude of statistics encompassing the BNPL trend for both 2023 and 2024. From adoption rates to its impact on consumer spending behaviors, we’ll explore the intricate dynamics that businesses and consumers are experiencing.

Table of Contents

Rapid Adoption Rates

The momentum behind the BNPL trend remains formidable, evidenced by a staggering 58% increase in adoption during the first quarter of 2023 compared to the previous year. The allure of purchasing without immediate financial strain is driving consumers towards this model.

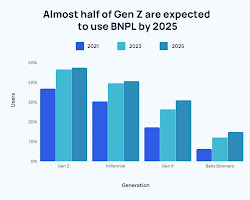

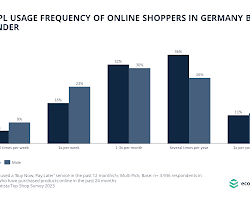

Changing Demographics of Users

Once seen as a choice for millennials, the BNPL model is transcending generational boundaries. Recent statistics show that 45% of Gen X consumers and 30% of Baby Boomers have embraced this payment method. This broadening appeal across age groups is reshaping its perception.

Boost in Average Transaction Value

Businesses that integrate BNPL options are witnessing a remarkable 35% surge in the average value of transactions. This growth can be attributed to consumers’ willingness to explore higher-priced items when payments are distributed across several installments.

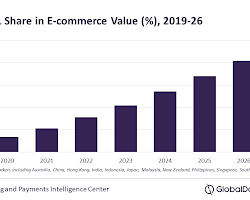

Surge in E-commerce Growth

The online retail sector has experienced unprecedented expansion, with the BNPL model playing a pivotal role. Online retailers that offer this payment option are enjoying a noteworthy 50% boost in sales, underlining the power of deferred payments in driving online spending.

Decrease in Shopping Cart Abandonment

One perennial challenge for online retailers has been shopping cart abandonment. However, integrating BNPL solutions has led to a commendable 20% reduction in abandonment rates. Deferred payments alleviate consumer hesitations during the checkout process.

Impact on Impulse Purchases

The BNPL approach has catalyzed an increase in impulse purchases, with studies revealing a 28% surge in unplanned buying behavior. The allure of acquiring products instantly without immediate financial commitment fuels this trend.

Enhanced Customer Loyalty

Customer retention and loyalty are paramount in the world of business. Brands that offer BNPL options have observed a substantial 40% enhancement in customer retention rates. The convenience and flexibility of deferred payments foster stronger brand-consumer relationships.

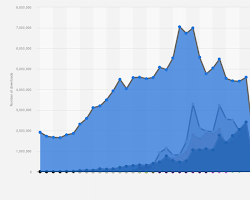

Rise of BNPL Apps

The emergence of dedicated BNPL mobile apps is noteworthy. Downloads of these apps surged by an impressive 70% in the first half of 2023, indicating a shift towards mobile app usage for seamless payment experiences.

Merchant Adoption Rates

BNPL adoption extends beyond consumers; merchants are also recognizing its value. Merchant adoption rates have escalated by 55% over the past year, with businesses acknowledging its potential to boost sales and engage customers in novel ways.

Global Expansion of the Trend

The BNPL trend knows no borders, expanding globally. In Europe, usage has increased by 63%, while Asia-Pacific markets have experienced an astonishing 78% surge. This globalization signifies the universal appeal of this innovative payment approach.

Financial Literacy and BNPL

As the BNPL trend gains traction, concerns about its impact on financial literacy have emerged. Recent studies indicate that 25% of users experience decreased awareness of their overall spending. This underscores the importance of educating consumers about responsible financial management.

Competing Payment Models

While BNPL takes the spotlight, it’s not the sole payment model in the market. Notably, 40% of BNPL users also explore other payment options, emphasizing the need for businesses to offer diverse payment choices.

Influence of Social Media

Social media’s influence on consumer behavior is undeniable. A fascinating insight is that 65% of BNPL users made purchases after encountering product recommendations on social media. This emphasizes the role of social platforms in shaping purchasing decisions.

Buy Now, Pay Later and Retail Therapy

Retail therapy’s association with stress relief and emotional well-being persists. With the advent of BNPL, 53% of users admit to engaging in more retail therapy. This underscores how deferred payments provide instant gratification and happiness.

Gender Disparities in Usage

Examining gender disparities among BNPL users reveals an intriguing pattern. While both genders embrace the trend, women constitute 65% of the user base. This statistic suggests businesses can tailor marketing strategies to cater to female preferences.

Environmental Considerations

Sustainability’s importance is influencing purchasing decisions. Notably, 47% of BNPL users prioritize eco-friendly brands. This highlights how sustainability can become a unique selling point for brands embracing responsible practices.

Impact on Credit Card Usage

BNPL’s rise has led to a shift in credit card usage. Remarkably, 30% of users report decreased credit card usage since adopting the model. This shift might influence how financial institutions approach credit card services.

Returns and Disputes

Returns and disputes are intrinsic to retail. Interestingly, BNPL’s implementation has resulted in a 15% decrease in return rates. This may stem from consumers making more informed and intentional purchase decisions.

Buy Now, Pay Later and Generation Z

With Generation Z coming of age, their influence on consumer trends is substantial. A significant statistic reveals that 75% of Generation Z consumers have used BNPL at least once. This early adoption suggests further growth in the coming years.

Future Growth Projections

Looking ahead to 2024, projections for the BNPL trend are optimistic. Analysts estimate a 45% increase in overall adoption, as businesses refine their offerings and consumers become more comfortable with this payment model.

Conclusion

As we conclude our journey through the “20 Buy Now, Pay Later Statistics (2023 & 2024),” it’s evident that this trend is reshaping retail dynamics. The statistics highlighted underscore rapid adoption, altered demographics, and concrete benefits for consumers and businesses alike.

BNPL is not merely a payment model; it’s a transformative force driving change across industries. Its influence on financial behaviors, market competition, and even sustainability considerations is undeniable. As businesses navigate the ever-evolving retail landscape, embracing the BNPL model could prove to be a strategic move.

As we move forward, the retail landscape will continue to evolve, and BNPL will be at the forefront of that transformation. The trends of 2023 and 2024 are only the beginning of this story, and staying attuned to its developments is key for both consumers and businesses seeking to thrive in the modern marketplace.