In the ever-evolving realm of finance and investments, staying ahead of the curve is paramount for success. As we usher in the year 2024, the demand for comprehensive investment platforms is on the rise. Among these, Dealroom has made its mark as a powerful tool for gathering investment insights. However, the landscape is rich with alternatives that offer advanced features and unique functionalities. This article delves into the best Dealroom alternatives for 2024, revealing platforms that provide a deeper understanding of investment opportunities and trends.

Table of Contents

10 Best Best Dealroom AlternativesTools:

1. Crunchbase: A Wealth of Company Data

Crunchbase stands as a prominent alternative, offering an extensive database of company information. With a focus on startups, investors can explore funding rounds, growth trajectories, and industry trends. The platform’s intuitive interface and real-time updates ensure investors have their finger on the pulse of the startup ecosystem.

Opens in a new window

Opens in a new window www.crunchbase.com

www.crunchbase.com

2. PitchBook: Unparalleled Private Market Insights

PitchBook shines in providing private market insights to investors. From deal tracking and valuation data to comprehensive industry reports, this platform offers a holistic view of investment opportunities. Its robust analytical tools empower investors to make informed decisions based on accurate data.

3. CB Insights: Predictive Analytics for Investments

For investors seeking predictive analytics, CB Insights is a formidable alternative. The platform employs AI to forecast market trends, identify emerging startups, and predict industry disruptions. This predictive approach equips investors with insights that drive strategic decision-making.

4. S&P Capital IQ: Data-Driven Investment Intelligence

S&P Capital IQ combines comprehensive financial data with advanced analytics to provide investment intelligence. Investors can access financial statements, market data, and sector insights, enabling them to make well-informed decisions backed by robust data.

5. AlphaSense: Harnessing AI-Powered Insights

AlphaSense leverages AI to sift through vast amounts of data and extract relevant insights. Investors can uncover hidden gems within earnings calls, news articles, and research reports, ensuring they never miss critical information that impacts their investments.

6. PrivCo: Focused on Private Company Intelligence

PrivCo specializes in private company intelligence, catering to investors interested in startups and privately-held firms. The platform offers detailed financials, M&A activity, and competitive analysis, providing a comprehensive understanding of the private market landscape.

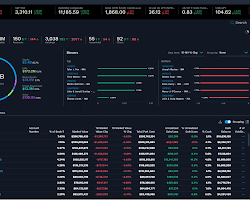

7. FactSet: Integration of Market Data and Analytics

FactSet is renowned for its integration of market data and analytics. Investors can access real-time market data, portfolio analysis, and risk management tools. This comprehensive approach ensures a holistic view of investment performance.

8. Owler: Dynamic Company Insights

Owler offers dynamic company insights powered by a community of contributors. Investors gain access to competitive analysis, funding rounds, and news updates. The collaborative nature of the platform ensures a diverse range of insights.

9. YCharts: Visualizing Investment Data

YCharts excels in visualizing investment data through interactive charts and graphs. Investors can track stock performance, analyze economic indicators, and create customized visuals that aid in decision-making.

10. PrivCo: Diving into Private Equity

For investors focused on private equity, PrivCo offers an in-depth platform. The platform provides information on private equity firms, funds, and deals. This specialized focus caters to investors seeking opportunities in the private equity landscape.

How to Choose the Right Dealroom Alternatives & Investment Research Tool for You

The right investment research tool for you will depend on your individual needs and investment goals. Here are a few factors to consider when choosing an investment research tool:

- Your investment goals: What are you investing for? Are you saving for retirement? Starting a business? Buying a house? Your investment goals will help you determine the type of information you need from an investment research tool.

- Your investment experience: How much experience do you have with investing? If you’re a beginner, you may want to choose a tool that is easy to use and provides a lot of educational resources. If you’re more experienced, you may want a tool with more in-depth data and analysis.

- Your budget: How much are you willing to spend on an investment research tool? There are a wide range of prices available, so you’re sure to find a tool that fits your budget.

Once you’ve considered these factors, you can start researching different investment research tools. Read reviews, compare features, and get quotes from different providers. With a little research, you’ll be sure to find the right tool to help you make informed investment decisions.

“In the world of investments, the right platform is your compass to informed decisions.”

Choose your investment path and navigate towards financial success.

Is Investment Research Right for You?

Investment research can be a valuable tool for investors, but it is important to understand the benefits and drawbacks before you decide to use it.

Benefits of Investment Research

- Increased knowledge: Investment research can help you to learn more about the companies and markets you are investing in. This knowledge can help you to make more informed investment decisions.

- Reduced risk: By understanding the risks involved in an investment, you can make more informed decisions about whether or not to invest.

- Better performance: Investors who use investment research tend to outperform those who do not.

Drawbacks of Investment Research

- Time-consuming: Investment research can be time-consuming, especially if you are not familiar with the process.

- Costly: Investment research tools can be expensive, especially if you need access to a wide range of data and analytics.

- Not always accurate: Investment research is not always accurate, and it is important to remember that past performance is not indicative of future results.

Conclusion : Dealroom Alternatives

Investment research can be a valuable tool for investors, but it is important to weigh the benefits and drawbacks before you decide to use it. If you are willing to invest the time and money, investment research can help you to make more informed investment decisions and improve your investment performance.

If you are not sure whether or not investment research is right for you, it is a good idea to speak with a financial advisor. A financial advisor can help you to understand your investment goals and needs and recommend the right investment research tools for you.

Read more articles

30 Growing Fintech Companies and Startups to Watch in 2024: Insights and Trends